Understanding the Tri-Valley Tax Levy

Scheduled for approval in December 2025, Payable in 2026

The primary funding source for Tri-Valley Schools, over 75% of the district's funds, are local property taxes. All taxing bodies including school districts must complete a tax levy which is a request for funds for the following year. The Tri-Valley Board of Education will vote to approve the formal tax levy at the December 17th board meeting, at 6:00 PM, at the Unit Office.

Tri-Valley Board Goals

The Board of Education annually authorizes the superintendent to create the levy for the district. This process is rooted in specific goals and standards. First, the Board of Education has established goals, with one specific to finance: Be creative financial stewards who collectively advocate for and invest in student growth and learning. Furthermore, the superintendent follows three operating norms for the school district’s finances:

Present to the public a balanced and fiscally responsible budget annually.

Maintain a steady property tax rate.

Consider alternative funding sources and grants whenever possible.

Tax Levy Projections and Impact

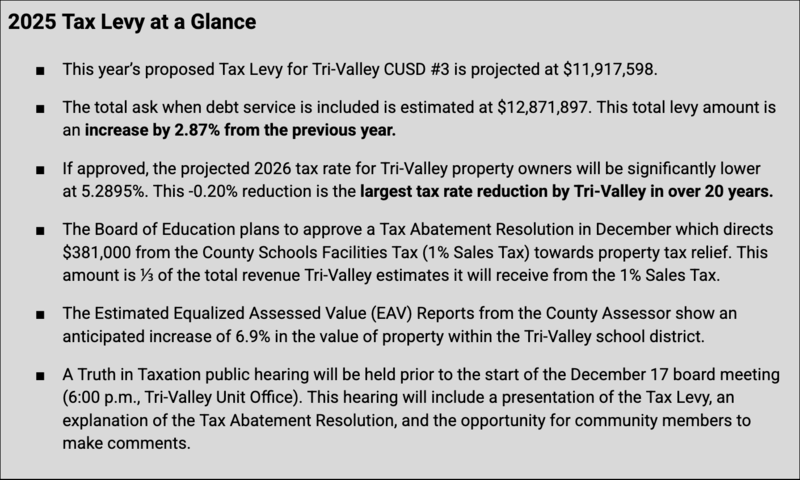

The projected 2025 Aggregate Tax Levy for the district is $11,917,598. This is a 6.36% increase from the 2024 Tax Levy. Nearly all of this increase is due to the increase in the Estimated Assessed Value (EAV) of property in Tri-Valley (+6.9%). The remaining increase is due to slight increases in anticipated costs within the fixed funds, primarily Tort & Liability.

In 2026, Tri-Valley CUSD #3 has $1,335,300 in pre-approved debt, or scheduled bond and interest payments. A Tax Abatement Resolution will be on the December 2025 Board meeting agenda which, if approved, would direct $381,000 towards a tax abatement payment. This Tax Abatement Resolution is the fulfillment of the Board of Education’s pre-election Resolution to commit at least ⅓ of revenue from the County Schools Facilities Tax (CSFT) towards property tax relief should a ballot measure pass. The CSFT ballot measure passed in the April 1 election and the 1% CSFT sales tax was initiated county-wide on July 1. After the Tax Abatement is applied, the remaining amount of bond and interest fees, $954,300, will be included in the Tax Extension.

When the scheduled debt is included into the Tax Levy amount, the total funds requested by Tri-Valley CUSD #3 is $12,901,274. This amount is an increase by 2.87% from the previous year.

The property tax rate for Tri-Valley CUSD #3 is estimated to be 5.2894% in 2026. This rate is a reduction by -0.20%, which is significantly lower due to the planned tax abatement. This projected tax rate will be the lowest for Tri-Valley since 2009 and the largest one-year reduction in more than 20 years.

How the Tax Levy is Created & Approved

The Tax Levy is the school district’s formal “ask,” or request, for property tax dollars to be used during the following year. The levy is established at Tri-Valley by the superintendent and approved by the Board of Education. This process includes a review of (A) the projected district budget (staffing, operational costs, and student needs) and (B) anticipated changes to the EAV (Equalized Assessed Value) of property in the district, which is set by the McLean County Assessor's office.

Each year the Board approves the Tax Levy at the December board meeting. The school district must submit a Board-approved Tax Levy to the County Clerk’s office by the last Tuesday in December in order to receive funding through local taxes. After receiving the levy, the County Clerk's office sets the Tax Extension which is the real revenue paid to the district. The extension is formally set upon the finalized EAV which is established later in the spring by the County Assessor.

How the EAV (Equalized Assessed Value) of property is set

Equalized Assessed Value (EAV) of property is set by the County Assessor, not the school district. The school district’s EAV represents ⅓ of the market value of all properties within the school district boundaries.

According to the County Assessor, the annual EAV review process includes (A) the addition of new construction, (B) farmland assessment, and (C) a sales ratio adjustment based on a comparison of property values to actual property sales. When the median of the sales ratio in a township is not equal, the County Assessor will apply a multiplier to equalize the sales ratio.

Estimate numbers are used for the Tax Levy because the levy must be submitted before the County Assessor sets official EAV rates in the spring. The increase in property EAV is not limited to just Tri-Valley. Sales of residential property in McLean County have continued to rise annually over the last 4 years. This continues to impact the sales ratio component of the County Assessors determination of EAV.

Tax Levy Timeline

November 19 - The board authorized the superintendent to prepare the tax levy. Initial

projections presented and discussed in open session.

November 24 - Tax Levy summary details posted on the school website

December 4-11 - Truth in taxation hearing notice posted in The Pantagraph.

December 17, 6:00 PM - Board of Education Meeting (6:00 PM, Unit Office); Meeting will begin with a Truth in Taxation Public Hearing (see details provided above); Board votes to approve the tax levy for submission to the County Clerk.

December 31 - Deadline to submit the school district’s tax levy to the McLean County Clerk.